Comprehensive Financial Suite for All

Empowering financial institutions with secure, consent-driven data access and analytics.

India's Most Advanced Financial Data Platform

Powering the future of financial services with secure, consent-driven data access and analytics

FIP Coverage in India

FIUs use OneMoney

Data Packets Delivered

Consents Fulfilled Monthly

Unlock access to diverse data sets

Why Choose MoneyOne for Financial Services

India's most advanced, secure, and integrated financial data platform

Powering 120+ FIPs and 50% of all Account Aggregator traffic in India.

Empower users with secure, consent-based access to their financial data.

Unlock actionable insights with advanced analytics and reporting tools.

RBI, SEBI, IRDAI compliant. ISO 27001, SOC 2, and GDPR-ready infrastructure.

Complete Financial Analytics Suite

Comprehensive financial data analysis with real-time insights and monitoring capabilities.

FOIR Percentage

Monitor Fixed Obligation to Income Ratio with real-time insights and comprehensive financial data analysis.

Average EOD Balance

Track end-of-day balance patterns to understand cash flow trends and financial stability indicators.

Expense Summary

Analyze spending patterns and categorize expenses to identify optimization opportunities.

FOIR Percentage

Understand FOIR (Fixed Income to Obligation Ratio) of your users

AND MANY MORE

Complete KYC Infrastructure

Streamline your customer onboarding with MoneyOne's comprehensive KYC solutions. From identity verification to financial data aggregation, we provide both FIU and FIP TSP services to ensure compliance and security.

KYC Checks Complete

Verification Accuracy

Average Processing Time

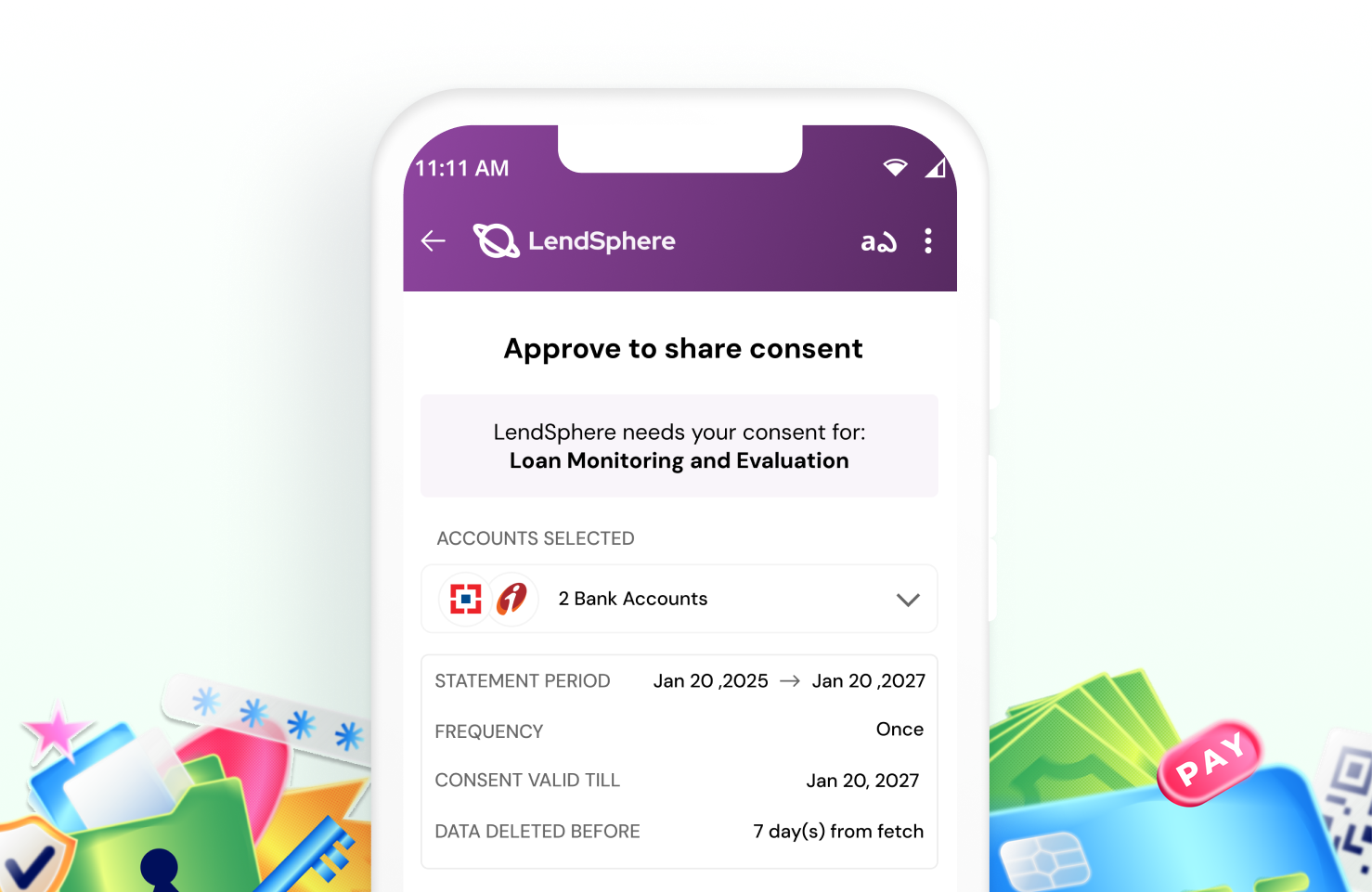

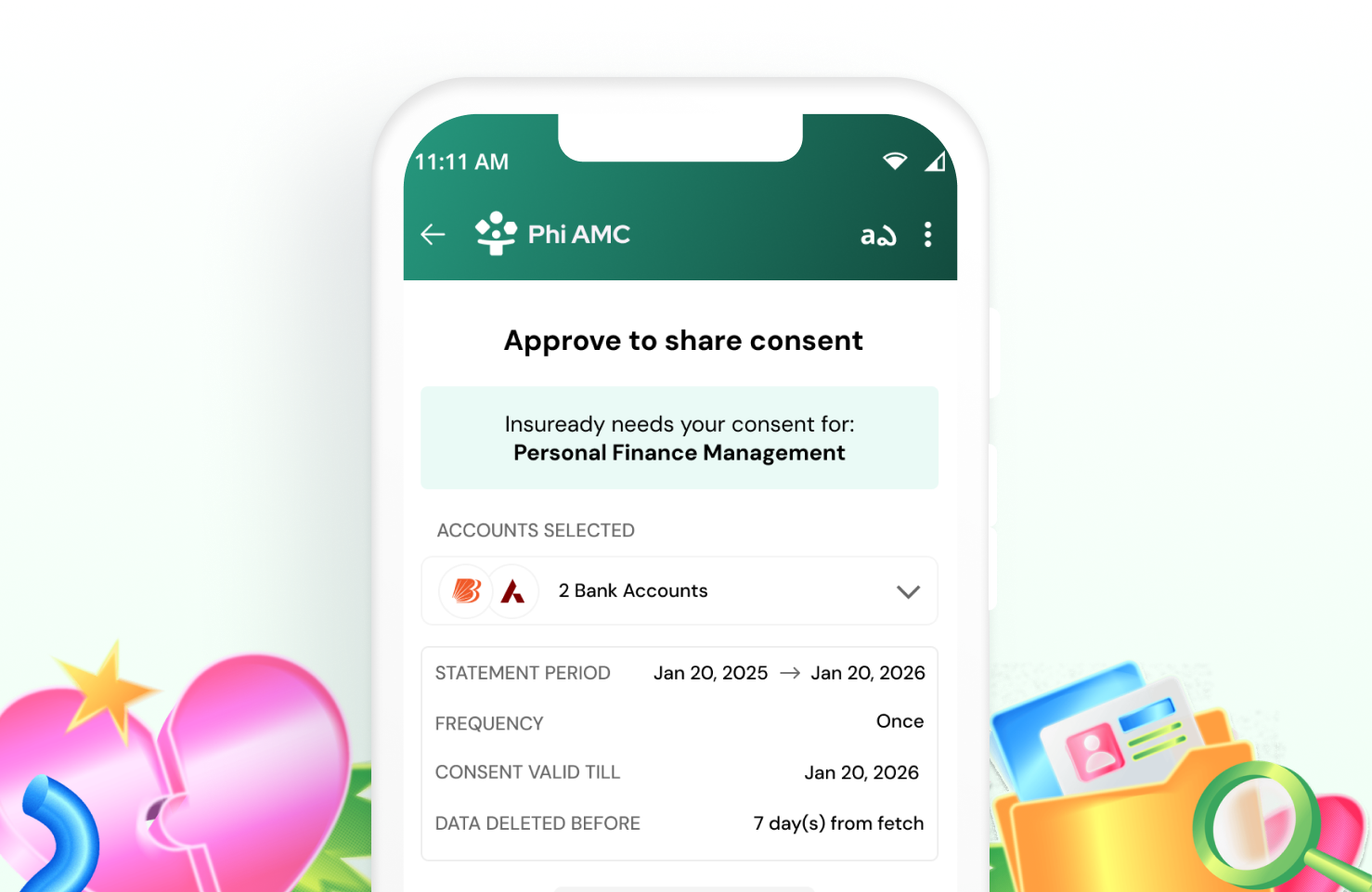

How Account Aggregator Works

Experience a seamless and secure way to manage and share your financial data, all powered by your consent.

Step 1: Secure OTP Login

Enter your mobile number and verify with a secure One-Time Password to begin the process. Your identity is confirmed swiftly and safely.

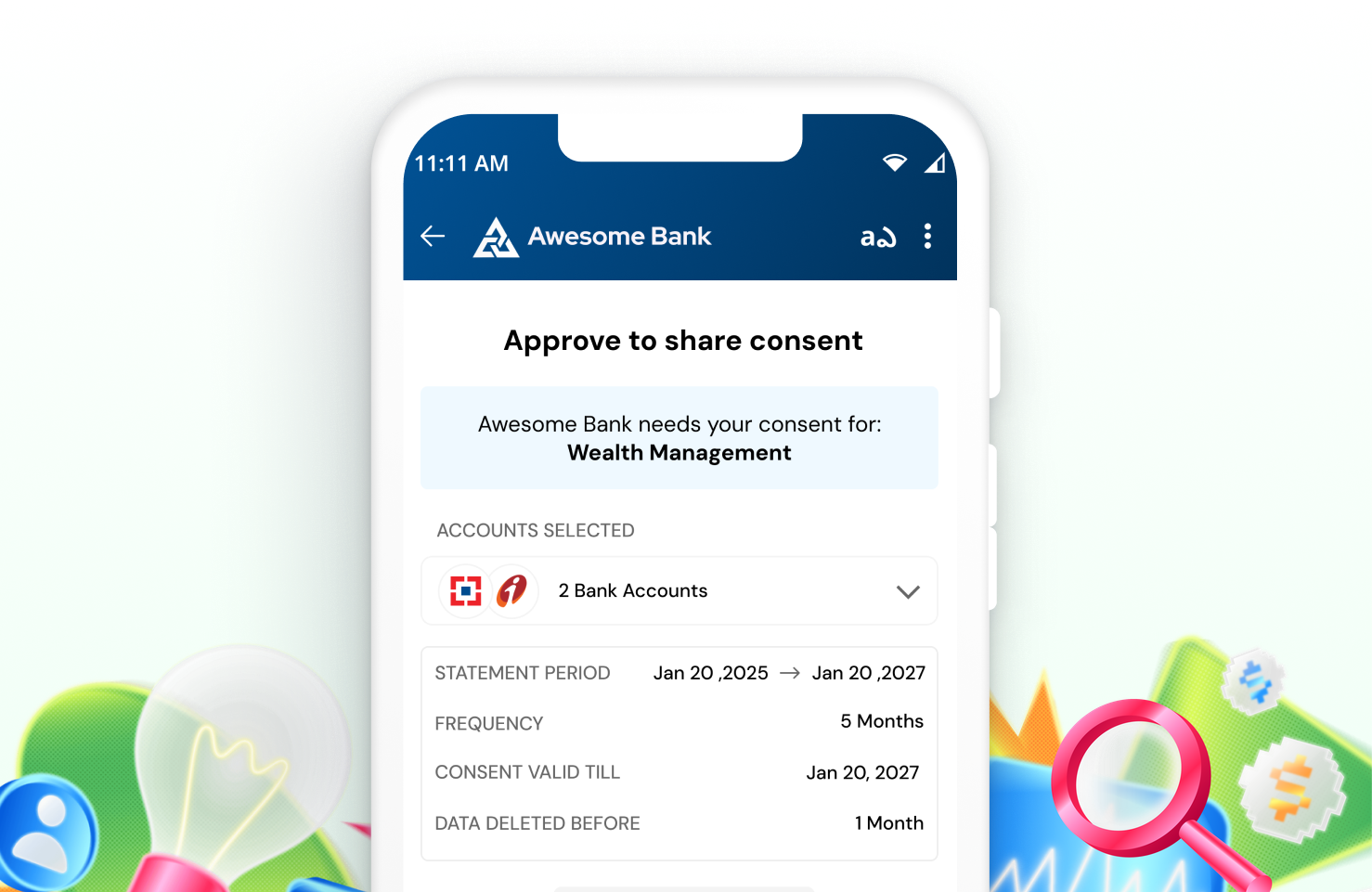

Step 2: Review & Grant Consent

Carefully review the data access request, choose the accounts you wish to share, and grant explicit consent. You are in full control.

Step 3: Action & Confirmation

The platform securely processes your request based on your consent. Receive instant confirmation once the action is successfully completed.

Complete Visibility Over Financial Data

Our platform helps institutions securely manage and share financial data in India's digital economy.

Understand Consent Trends

Track consent trends to measure operational efficiency and user conversion. Spot anomalies and optimise workflows for better data availability.

Understand Consent Distribution

Monitor consent health in real-time to ensure steady data inflow. Identify delays and improve user conversion through proactive actions.

Understand FIP Performance

Analyse FIP efficiency in fulfilling data requests. Make informed decisions on prioritisation and reduce data retrieval failures.

Consent Trend

Understand overall trend and day-wise performance of consents

Tailored Solutions for All Use Cases

Discover how OneMoney empowers businesses of all sizes with secure and compliant data solutions.

Ready to BoostYour Financial Services?

Have questions or ready to get started? Reach out and let us know how we can help.

Whether you're interested in learning more about our Account Aggregator services, exploring partnership opportunities, or have specific questions, our team is ready to assist you. Fill out the form or use the contact details provided in our footer.

We aim to respond to all inquiries within one business day.