Empower Your Financial Product with Intelligent Data Access

FinPro is MoneyOne's flagship FIU TSP solution, enabling seamless integration with the Account Aggregator ecosystem to help financial institutions access, analyze, and act on consented financial data — fast, secure, and compliant.

What is FinPro ?

FinPro is a robust FIU (Financial Information User) TSP solution that allows banks, NBFCs, insurers, and fintechs to pull user-permissioned financial data through the Account Aggregator framework.

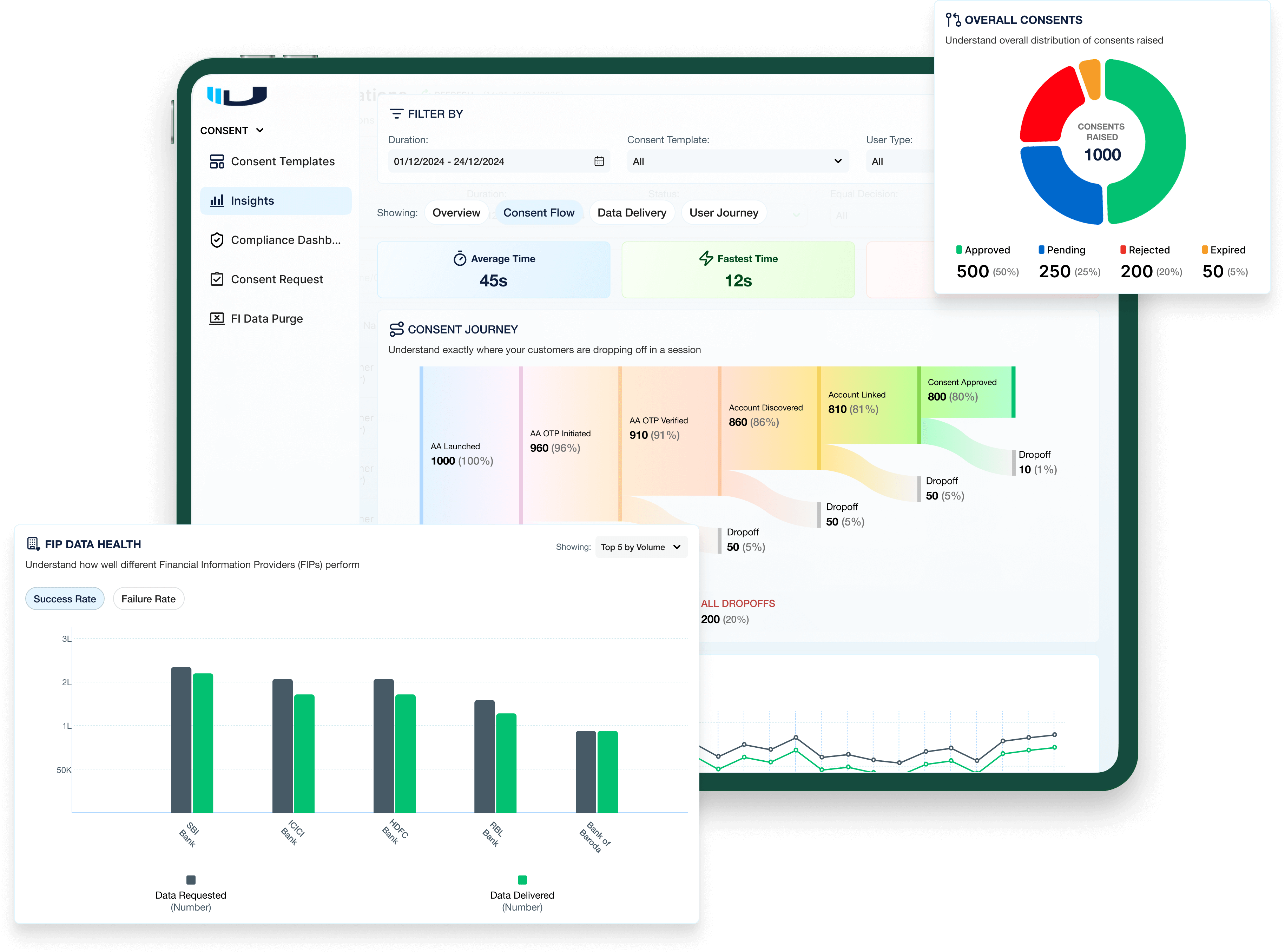

Understand Consent Trends

Track consent trends to measure operational efficiency and user conversion. Spot anomalies and optimise workflows for better data availability.

Understand Consent Distribution

Monitor consent health in real-time to ensure steady data inflow. Identify delays and improve user conversion through proactive actions.

Understand FIP Performance

Analyse FIP efficiency in fulfilling data requests. Make informed decisions on prioritisation and reduce data retrieval failures.

Consent Trend

Understand overall trend and day-wise performance of consents

Trusted by Financial Leaders

Banks & NBFCs use FinPro

AA Integrations

Consent Requests Monthly

Uptime Guarantee

Unlock access to diverse data sets

Core Capabilities

FinPro delivers comprehensive FIU capabilities through a single, powerful platform designed for modern financial institutions.

WITHOUT FINPRO

WITH FINPRO

Sample Use Cases for FinPro

Discover how FinPro transforms financial services across various industries with intelligent data access and insights.

Automate income verification with real-time bank statement data

Instant Income Verification

Cash Flow Analysis

Credit Risk Assessment

Tailor advice based on customer asset mix (MF, FDs, Stocks)

Portfolio Consolidation

Asset Allocation Analysis

Investment Recommendations

Pre-screen users with cashflow insights from AA data

Real-time Eligibility

Spending Pattern Analysis

Risk Profiling

Match premiums to user profile using verified financial history

Risk Assessment

Premium Calculation

Claims Validation

Developer Toolkit

Everything developers need to integrate FinPro quickly and efficiently.