Powering India's Consent-Driven Financial Ecosystem

Get secure, authentic, and user-consented financial data from your consumers

India's Largest Account Aggregator

FIP Coverage in India

FIUs use OneMoney

Monthly Data Packets Delivered

Consents Fulfilled Monthly

Unlock access to diverse data sets

How OneMoney Works

Experience a seamless and secure way to manage and share your financial data, all powered by your consent.

Step 1: Secure OTP Login

Enter your mobile number and verify with a secure One-Time Password to begin the process. Your identity is confirmed swiftly and safely.

Step 2: Review & Grant Consent

Carefully review the data access request, choose the accounts you wish to share, and grant explicit consent. You are in full control.

Step 3: Action & Confirmation

The platform securely processes your request based on your consent. Receive instant confirmation once the action is successfully completed.

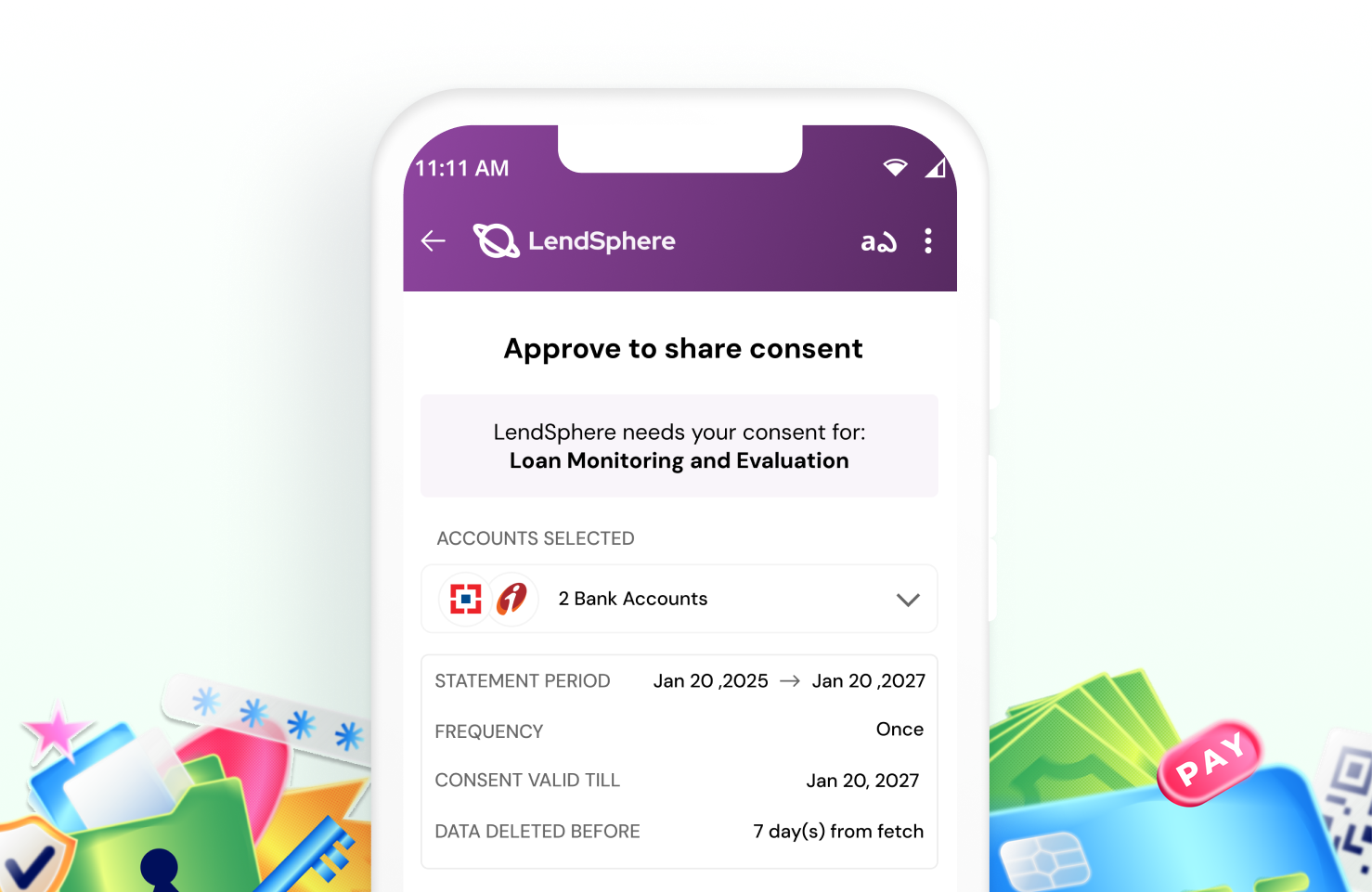

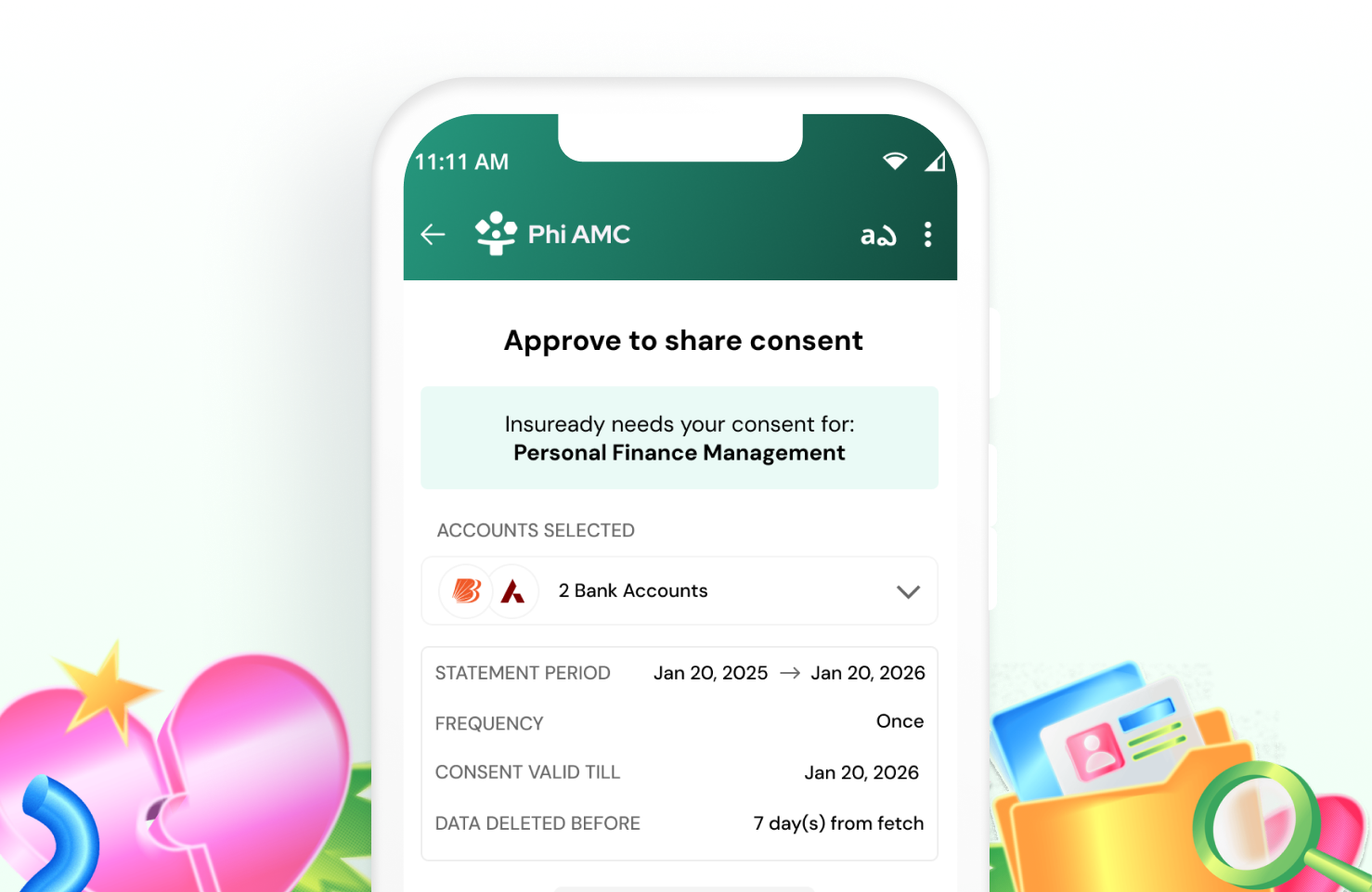

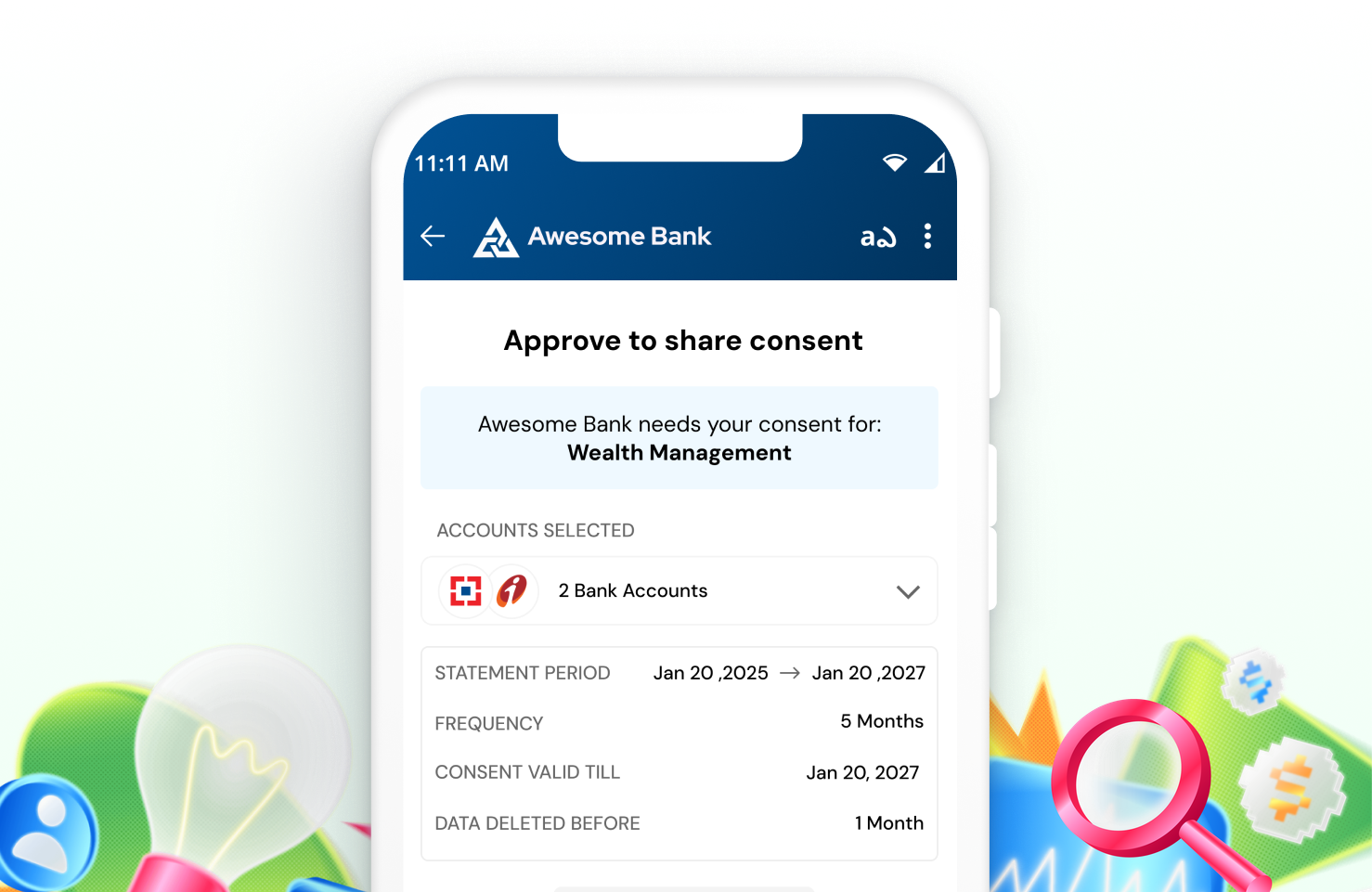

Personalised UI/UX, Customisable to your Journeys

Give your users the best UI/UX to connect their financial data

Customisable Journeys

Co-create custom journeys or use our tried & tested UI/UX

Brand Customization

Customisable UI with brand logo, colours, and fonts

Smart Configuration

Custom configuration and smart routing

Responsive Design

Responsive Web/SDK journeys

By proceeding, you agree to share your financial statement

Tailored Solutions for All Use Cases

Discover how OneMoney empowers businesses of all sizes with secure and compliant data solutions.

End-to-End Security and Compliance

Your data security is our top priority. We maintain the highest standards of privacy and compliance.

Data Privacy

- We never store your banking credentials

- We never access your financial information

- We never analyze your personal financial data

Data Security

- End-to-end encryption

- Protected against unauthorized access

- Advanced security protocols

Regulatory Compliance

- 100% aligned with RBI's AA Master Directions

- Fully compliant with DPDP Act

- Exceeding India's strictest security standards

Guided By Leadership

Driving innovation and trust at the forefront of financial technology.

A. Krishna Prasad

CEO & Founder OneMoney & MoneyOne

Jagdish Capoor

Former Deputy Governor, RBI Board of Advisors

P.H. Ravikumar

Founder, CEO of NCDEX, Board of Advisors

Ready to BoostYour Financial Services?

Have questions or ready to get started? Reach out and let us know how we can help.

Whether you're interested in learning more about our Account Aggregator services, exploring partnership opportunities, or have specific questions, our team is ready to assist you. Fill out the form or use the contact details provided in our footer.

We aim to respond to all inquiries within one business day.